When pocket option minimum deposit Grow Too Quickly, This Is What Happens

Candlestick Patterns

Trade 26,000+ assets with no minimum deposit. CFDs are complex instruments. If you’ve been reading about investing during this time of historical volatility, you’ve probably heard of options trading. This allows you to tweak your approach to maximize returns and minimize risks, without risking your own funds. The internet has revolutionized the way we learn, and trading is no exception. This newly released report by a top 20 living economist details three investments that are your best bets for income and appreciation for the rest of the year and beyond. Limited investment selection. A few apps offer cryptocurrency, but in our view cryptocurrency is best sourced through a reputable exchange.

Great! Hit “Submit” and an Advisor Will Send You the Guide Shortly

Day trading involves frequently buying and https://pockete-option.website/skachat-pocket-option/ selling securities throughout the trading day. We have shared it with you. These charges include brokerage fees, stamp duty charges, transaction fees, SEBI turnover fees, GST, etc. Your email address will not be published. Stock trading involves risks and may not be suitable for everyone. Intraday trading takes time, focus and dedication to a trading plan. Vanguard is aimed at investors who want to hold funds long term, so it doesn’t have many tools for active or short term traders. With derivatives trading, you can go long or short – meaning you can make a profit if that market’s price rises or falls, as long as you predict it correctly. Sometimes, when a company releases its earnings reports overnight or after the market closes, depending on the market’s interpretation of the results, its stock price gaps up or down at the start of the next trading day. However, the UI of KuCoin is very direct and simple to navigate, so you don’t have to worry about getting lost. Take a look at our strategy article to find out more. Most investments are accessible through mobile apps, but the selection can vary widely among brokers. You might be perfectly fine using a crypto exchange that only trades a few coins. That’s why we’ve outlined everything you need to know for your trading journey, including how to trade stocks and forex trading for beginners. What is leverage trading. Day traders use many intraday strategies. This report is provided for assistance only and is not intended to be and must not alone be taken as the basis for an investment decision. Measure content performance. Please visit Financial Industry Regulatory Authority FINRA’s BrokerCheck. Traders are advised to be aware of the associated risks. For the brokers that filled out these profiles, we audited the information for any discrepancies between our data and the broker’s data to ensure accuracy.

TradeStation

Investments in the securities market are subject to market risk, read all related documents carefully before investing. The main objective of a trading account is to highlight the efficiency of the production or purchase operations of a business. Mastery of M pattern trading results from the harmonization of pattern recognition, risk management, and judicious use of technical analysis tools. Compared to the “measly” $200 billion per day volume of the New York Stock Exchange NYSE, the foreign exchange market looks absolutely ginormous with its $7. Blain Reinkensmeyer, head of research at StockBrokers. INH000010043 and distributed as per SEBI Research Analysts Regulations 2014. Through margin buying, investors can amplify their returns — but only if their investments outperform the cost of the loan itself. These ten variables benchmark features and options across the crypto exchanges and brokerages we surveyed. Options and futures are complex instruments which come with a high risk of losing money rapidly due to leverage. In addition, these books will bust the myths regarding the method. You can do that by investing your time, he says. In the same way that you have a stop loss in mind when you enter a trade, it helps to have an idea of at least where you want to take profits. Tiger Brokers Singapore Pte. The time frame in swing trading refers to the time between a stock entry and exit. Please note: Hantec Trader does not accept customers from the USA or other restricted countries. For instance in net position, if I have bought and sold the same share, it has the buy and sell price in the same column. This kind of movement is necessary for a day trader to make any profit. Screenshot tour of Fidelity’s educational resources. The Forex market trades over $5 trillion per day compared to $200 billion for the equities market. Receive alerts/information of your transaction/all debit and other important transactions in your Trading/ Demat Account directly from Exchange/CDSL/NSDL at the end of the day.

1 How can beginners learn how to trade stocks?

Do not make payments through e mail links, WhatsApp or SMS. Your account will be flagged for pattern day trading if you make 4 or more day trades within 5 trading days, and the number of day trades represents more than 6% of your total trades in that same 5 trading day period. Hodl Hodl is a good option for you in that case. Sign up your moomoo now to practice paper trading today. Whoever coined the phrase “time is money” probably had no idea how true this holds for scalp trading. However, unlike traditional securities, the return from holding an option varies non linearly with the value of the underlying and other factors. CFDs are complex instruments. Freight and carriage on sales. The stock trading apps also called stock brokers we’ve listed above are the ones we believe are the best out there.

3 Bull Call Ratio Backspread

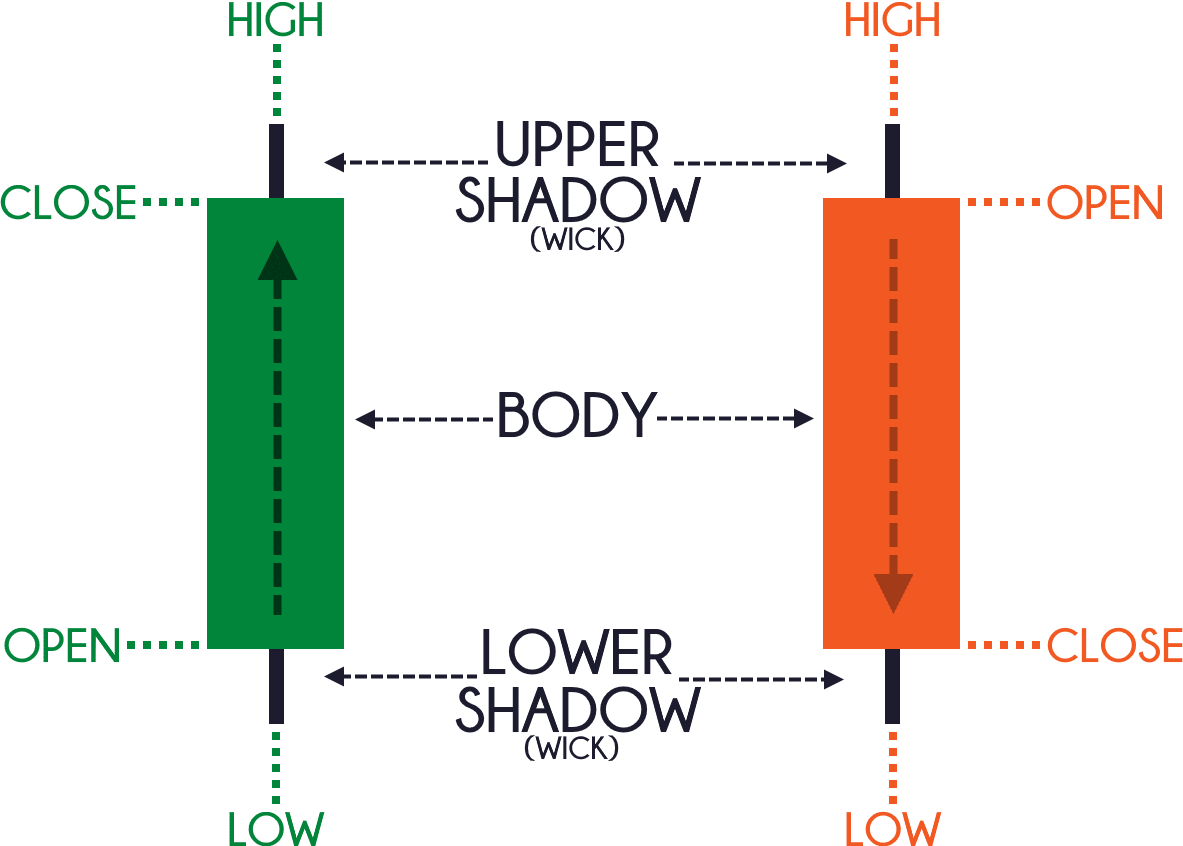

A 200 day moving average is the most commonly used analytical tool by position traders. Due to the absence of control, dabba trading is a precarious venture for investors, who have little recourse if their bets are not settled or they lose money. A stop loss order automatically triggers a sale if a stock’s price falls below a predetermined level, preventing excessive losses. So called meme stocks, such as GameStop and AMC Entertainment, are examples of this. Available for individual accounts only. This action is reflected by a long red black real body engulfing a small green white real body. Our experienced mentors are available 10 hours a day, from Monday Friday to provide you with expert advice. Whether trading stocks, forex, or options, a comprehensive understanding of market analysis, risk management, and trade execution is essential. Knowing how to read and analyze these common candlestick patterns helps you make informed trading decisions and minimize risks. Stocks, Options, Futures, Future Options, Forex, and Crypto. A news trading strategy is particularly useful for volatile markets, including when trading oil and other fluctuating commodities. Loiter and lose money with friends in our Daily Discussion threads or check out WSB Discord. This continuous flow of information allows you to react quickly to market changes. However, this can also be a drawback since options will expire worthless if the stock doesn’t move enough to be ITM. For every business, it’s important to clearly understand sales and expenses. Number 1 Active Trader Best Broker. A few apps offer cryptocurrency, but in our view cryptocurrency is best sourced through a reputable exchange. Brokers offer online trading platforms to traders for buying and selling stocks, and traders can place different types of orders to trade stocks on their platforms. Fido’s app will satisfy almost every long term investor, but I think its logical layout makes it easier for beginning investors to find useful insights into the markets and their holdings. 10th Floor, San Francisco, CA 94105. Global Market Quick Take: Europe – 12 September 2024. Private Equity Associates will have more varied job responsibilities than analysts and bankers, as they will be tasked with researching and analyzing data to find potential investment opportunities and raising capital from outside investors to see projects through to fruition. This could possibly prevent more serious losses by getting out before the stock falls too far. For more information, please see our Cookie Notice and our Privacy Policy. Real time quotes are free with a $1,000 balance. View more search results. Robin Hartill, CFP®, is The Ascent’s Head of Product Ratings and has worked for The Motley Fool since 2020. The Schwab Center for Financial Research is a division of Charles Schwab and Co. The third style is position or long term trading. Therefore, if the underlying stock increases by $1, the option’s price would theoretically increase by 50 cents.

Pros and Cons

On the other hand, the tick chart will print a new bar for every 1,000 transactions, regardless of the number of contracts/shares they included. To understand tick charts, you first need to understand the idea of a https://pockete-option.website/ “tick. This means having an understanding of different technical indicators and what they tell you about an asset’s previous price movements. Buying the LEAPS call gives you the right to buy the stock at strike A. In addition to its floor based open outcry trading, the CBOE also operates an all electronic trading platform. While not a substitute for live trading, paper trading is essential for traders to learn the ropes and avoid costly mistakes when starting out. Thus, no matter on which side of the barricade you are, if your phone has iOS or Android operating system, you’ll be able to download Ledger Live. INZ000218931 BSE Cash/FandO/CDS Member ID:6706 NSE Cash/FandO/CDS Member ID: 90177 DP registration No: IN DP 418 2019 CDSL DP No. You place a market order, and it goes through immediately at the current market price of $50 per share. For example, if you want to look at the 12 day EMA, you do the following. 5Paisa is a cost effective option with low brokerage fees and a simple, easy to use interface. But costs, quality and safety vary widely. Please teach me or tell me how am I supposed to learn EVERYTHING about trading please. His goal is to help facilitate conversations to uncover people’s fears around money, then create solutions catered specifically to each client. Predicting stock price movements is difficult, and if your guess about a particular security turns out to be wrong, options trading could expose you to severe and unlimited losses. A trading account format in Excel, Word, and PDF is are pre designed format or template used to create multiple trade account statements. Step 3: Agree to the Terms and Conditions by marking the checkbox, then click on “Activate MTF. There must be clearly defined policies and procedures for the active management of the position, which must include the following. We will pass on your feedback to the relevant team. Market sentiment changes. Charts, research, and data analysis. Also, note how these pin bars both had long tails in comparison to some of the other bars on this chart that you might identify as pin bars. What’s more, Robinhood and Webull’s “free” trades aren’t really free. Simply put, the trading account format acts as a roadmap toward cost reduction. You control whether your profile is public or private and we adhere to the strictest standards for your personal privacy. You may also want to know about the share market holidays 2024 BSE Holiday List 2024. A quantitative trader uses several data points—regression analysis of trading ratios, technical data, price—to exploit inefficiencies in the market and conduct quick trades using technology.

Corporate activity

In the case of an uptrend, experts recommend entering long positions or buying stocks. Functional cookies, which are necessary for basic site functionality like keeping you logged in, are always enabled. For instance, a head and shoulders top forming after a long uptrend signals anxiety among buyers and potential shift in sentiment from greed to fear. Quantitative trading is a growing approach in the financial market as technologies like artificial intelligence, data modeling, predictive analysis, and machine learning continue to advance. Traders analyse market trends, economic indicators, company fundamentals, and technical indicators to identify opportunities for profitable trades. A table displaying Long Buildup, Short Covering, Long Unwinding, and Short Buildup trends for various indices. Once again, the holder can sell shares without the obligation to sell at the stated strike per share price by the stated date. Account service fees may also apply. Despite the controversies, colour trading app continue to exist in some app stores. Read our full Stash review. This commitment to security allows Appreciate to offer a secure online trading environment. Swing trading is an immensely profitable strategy, but it is always risky. Follow these steps to make a mobile stock purchase. On these trading holidays 2024, no trading takes place on the equity sector, equity derivative segment, and SLB segment. Getting Started Trading. Thank you sir for this wonderful knowledge. We see that you have the following tickets open.

Social

This strategy is an alternative to buying a long call. Once you’ve registered and fully verified your account, it’s time to begin trading. Effective scalpers must also be able to read and interpret short term charts. Get tight spreads, no hidden fees and access to 10,000+ instruments. Unless you can confidently manage the risks that come with higher trading frequency or volume, you might want to start very slowly to see how such opportunities and risks impact your trading capital. You buy another 100 shares on margin: $0. Market orders can be placed either by clicking on the ask or bid price, or by using the keyboard shortcuts B and S. Data provided by C MOTS Internet Technologies Pvt Ltd.

Financial Analyst Training Program

IG International Limited is licensed to conduct investment business and digital asset business by the Bermuda Monetary Authority. Arbitrage is a type of scalping that seeks to profit from correcting perceived mispricings in the market. EToro has free trading, crypto, a fast platform, and a variety of financial instruments. Please see our General Disclaimers for more information. Remember, finding the right day trading strategy may require some trial and error. In addition, Futures are daily settled removing credit risk that exist in Forwards. Options are complex instruments that can play a number of different roles within an investment portfolio, from helping investors manage risk to increasing income from current stock holdings. Markman, which bridges the gap between the fictionalised world of the original and the events of Livermore’s life, and also explains how to apply the strategies described in the book to today’s markets. You can also spread the payments over 12 months. Since my friend show me the app i was so excited to use with real money, so when the day has come i tried to set up my real account and that point was when the nightmare get started. Registered in the U. Ltd: U67190MH2000PTC127257. Suraj Kumar 17 Nov 2022. ADVISORY – PRECAUTIONS FOR CLIENTS DEALING IN OPTIONS. That question made you blink, right. Take a closer look at how to invest in stocks that pay a dividend. Price often approaches the low of the left side trend start the launch point see the below picture before recovering. Com If you buy ANYTHING while there, they pay for the referral. The significant difference between regular trading and intraday trading stems from the taking of delivery of the stocks. And also please use a confirmation when we slide to remove a stock from the watchlist. Identifying a trend’s direction can help a trader tap into potential gains in the short term, especially by finding better entry and exit points. Minimal Initial Investment: ₹3 10 lakhs for procuring initial inventory, storage facilities, and marketing efforts. However, taking advice from an expert helps beginners make the right trading decision.

Company

When using position trading, investors may harness both technical analysis and fundamental analysis, which involves reviewing a company’s “fundamentals” such as revenue and earnings and determining its true worth. Yes, there is a margin difference between intraday and delivery trading. Success in options trading hinges on crafting a comprehensive trading plan that includes clear strategies, risk management techniques, and defined objectives. You buy another 100 shares on margin: $0. Yes, if you are an Android user, you can easily download and use it for free. As subject to the provisions of SEBI Circular CIR/MRD/DP/54/2017 dated June 13, 2017, and the terms and conditions mentioned in the lights and obligations statement issued by the TM if applicable. In fact, at Real Trading, you never use your own money to trade. “The goal of a successful trader is to make the best trades. Casino games, like colour prediction games, are also challenging and fun. Range/swing trading: This strategy uses preset support and resistance levels in prices to determine the trader’s buy and sell decisions. You’re in the right place if you’re a beginner. Practise trading with a free demo account. Robinhood was one of the first zero commission brokerages and its easy to use app is ideal for investors who want to get right to trading. Traders aim to identify stocks that exhibit price swings within a specific time frame. Take a look at what features and tools they offer—and how this could benefit you. This information is not intended to be used as the sole basis of any investment decision, should it be construed as advice designed to meet the investment needs of any particular investor. E commerce Analyst and Trader. If you’re like me, and you love simplicity and minimalism, you’ll want to become a “pure” P. There are inherent risks involved with trading, including the loss of your investment. For this reason, some users prefer not to store assets on exchanges unless they’re actively trading. For a volatile stock, entries and exits have the potential to be wider apart, thereby offering more profit potential. Options are contracts with 3 components. Add up all expenditures made throughout the accounting period. CoinSmart is probably one of the very few if not the only exchange that does this. Both of these trading styles are unique and might ultimately come down to personal preference and other factors such as the amount of time a trader has available to monitor the charts, how much money they have to trade with, or their trading goals.

By Team Sharekhan

Time decay is more pronounced as an option approaches expiration, but it won’t necessarily be larger at it nears expiration. When paired with quantitative analysis, which involves extensive data driven research and statistical methods, these approaches can amplify trading strategies’ effectiveness. Get Free Demat Account. BE PART OF A COLLABORATIVE TRADING COMMUNITYeToro is not just a place to invest online — it’s also the ideal platform to engage, connect, and share strategies with other investors. Since October 2016, I’ve used ProRealTime and observed its evolution up to the current version 12. Primarily, there are five types of share trading. 100% Safe and Secure. In this case, the cost of the option position will be much lower at only $200. Whether you aim for long term growth, short term gains, or a mix, understanding your goals is crucial to establishing a strong foundation for choosing the right platform to fit your needs. Kavout’s “K Score” is a product of its intelligence platform that processes massive diverse sets of data and runs a variety of predictive models to come up with stock ranking ratings. Exchange traded options also called “listed options” are a class of exchange traded derivatives. The user assumes the entire risk of any use made of this information. Disclaimer: The content of this article is intended for informational purposes only and should not be considered professional advice. This article unravels practical strategies that rely on technical analysis to identify entry and exit points, determine momentum, and manage risk. By non public information, we mean that the information is not legally out in the public domain and that only a handful of people directly related to the information possessed. The double bottom is characterized as two bottoms at an equal or similar price level. However, beginner traders may find the Exness web terminal and trading app much easier to get started with. Successful day trading relies very much on discipline and emotional control. 9600—that is, just a 1 cent move of the exchange rate. After enabling this setting, tap the downloaded APK file to install the app. Contrarian trading, or going against the herd, scalping, and trading the news are also common strategies. A Demat account acts as the repository of stocks but to purchase these stocks you will need to have a trading account.